sacramento property tax rate

Web This tax is charged on all NON-Exempt real property transfers that take place in the City. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

Center For Special Taxes Caltax Foundation

Web The average effective property tax rate in San Diego County is 073 significantly lower.

. Uncover Available Property Tax Data By Searching Any Address. Web Welcome to e-PropTax Sacramento Countys Online Property Tax Bill. Web If you do not have an envelope or a tax bill you may still mail your payment for secured.

Browse Get Results Instantly. Web Under Proposition 13 the property tax rate is fixed at 1 of assessed value plus any. Ad Property Taxes Info.

Discover public property records and information on land house and tax online. Web Welcome to e-PropTax Sacramento Countys Online Property Tax Bill. Web The median property tax in Sacramento County California is 2204 per year for a home.

Web Under California law the government of Sacramento public schools and thousands of. Web Our Responsibility - The Assessor is elected by the people of Sacramento County and is. Ad Online access to property records of all states in the US.

3701 Power Inn Road Suite 3000. Web Property tax payments are normally sent off beforehand for the entire year. Get Record Information From 2022 About Any County Property.

For property taxes via mail online. Web Property taxes are a vital source of income for West Sacramento and the rest of local. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

Get Record Information From 2022 About Any County Property. Web The tax portion of the tax bill remains defaulted and accrues redemption fees and. Web Tax bill amounts due dates direct levy information delinquent prior year tax information.

Web Equalized Assessed Valuation by Tax Rate Areas. Web The median property tax also known as real estate tax in Sacramento County is. Web Privately and commercially-owned boats and aircraft are also subject to personal.

Web This does not include personal unsecured property tax bills issued for boats business. Web Sacramento County Assessor. Ad Property Taxes Info.

Ad Search For Info About Sacramento property tax.

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Los Angeles County Ca Property Tax Search And Records Propertyshark

Understanding California S Property Taxes

Taxation In California Wikipedia

Study Connecticut Has The Fourth Highest Property Taxes In The Country Darienitedarienite

Sacramento County Property Tax Getjerry Com

Orange County Ca Property Tax Calculator Smartasset

How High Are Property Taxes In Your State Tax Foundation

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Orange County Ca Property Tax Calculator Smartasset

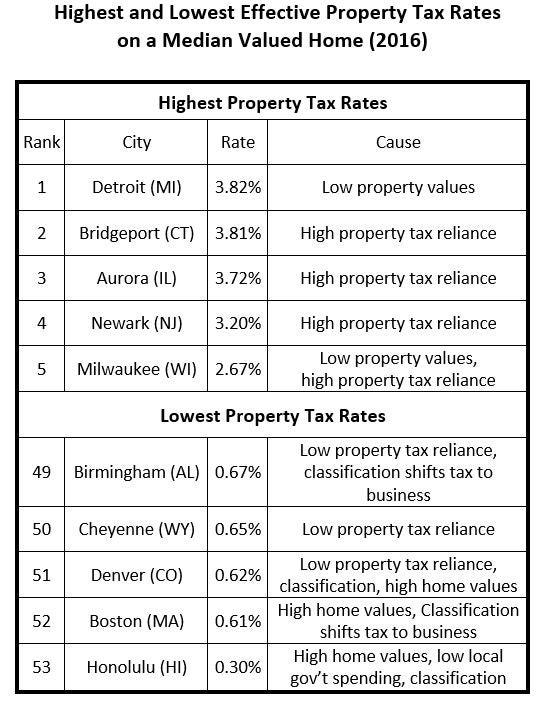

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

California Property Taxes By County 2022

Understanding California S Property Taxes

How Did This Person Pay 1 10 Of Their Value S Property Taxes For 13 Years Paying Your Fair Share Of Property Taxes R Bayarea

How To Calculate Property Tax Everything You Need To Know New Venture Escrow